The Importance of Econ & Finance

October 31, 2017

Throughout high school I kept waiting and waiting for the part where I would learn about life skills that I’m actually going to use. Now, please don’t tell me I’m going to need to know the amplitude of a parabola or how to calculate the acceleration during free fall on the moon, because you know that’s not what I’m talking about.

The fact is (obviously) depending on what you want to do, most of what we are taught during our time in high school will become irrelevant.

However, one class in particular has taught me more useful life information than any other class combined.

This class is Personal Finance and Economics, taught by our very own Mr. Danny Hirsch.

While Mr. Hirsch was himself attending dTHS, he gained a love of economics that inspired him while studying for his BA at Pomona College to gain a minor in Economics.

I have been in this class for a little over two months, and although it is a one semester class, I have already learned so much.

The units we study include: budgeting, banking, credit, taxes, insurance (specifically health and car insurance) and how to invest saved money wisely and carefully.

Knowing how to budget, knowing how the banking and credit systems work, knowing what kind of insurance is right for us and even understanding how we are being taxed, is something we will all need to know when we go to college and become somewhat financially independent of our parents.

I spoke to Mr. Hirsch to find out what he thinks on the matter. He told me, “we can all agree, regardless of what religion you are or where you live, that you do need to make informed financial decisions for the rest of your life.”

A fellow Econ student, Elad Cohen, told me that he feels “taking Econ was the best decision. I originally just needed to fill a class in my schedule but I ended up being so grateful and I’ve learned so much.”

I am a senior. This means that by this time next year, I will be attending an institution that is completely unknown to me. While I can’t really plan for this, I can plan how I will get by. My parents will give me an allowance and I will have to stretch that budget to cover all of my expenses.

Having taken Personal Economics & Finance, I know that I would be able to do that.

This is why I believe Personal Finance & Economics should be a graduation requirement. We will need these skills for the rest of our lives and yet no one has taught us how to budget or how taxes work. I didn’t even know that we had to pay both federal and state income taxes (although that may just be because I’m foreign).

Mr. Hirsch agrees – everyone should graduate with at least a basic understanding of how the finance world works.

I have learnt in Mr. Hirsch’s class that “it doesn’t matter how much you make, it matters how much you save and stay within your means.”

Mr. Hirsch told me his goal in teaching the class was that “students would learn some of the basic skills to living within their means.”

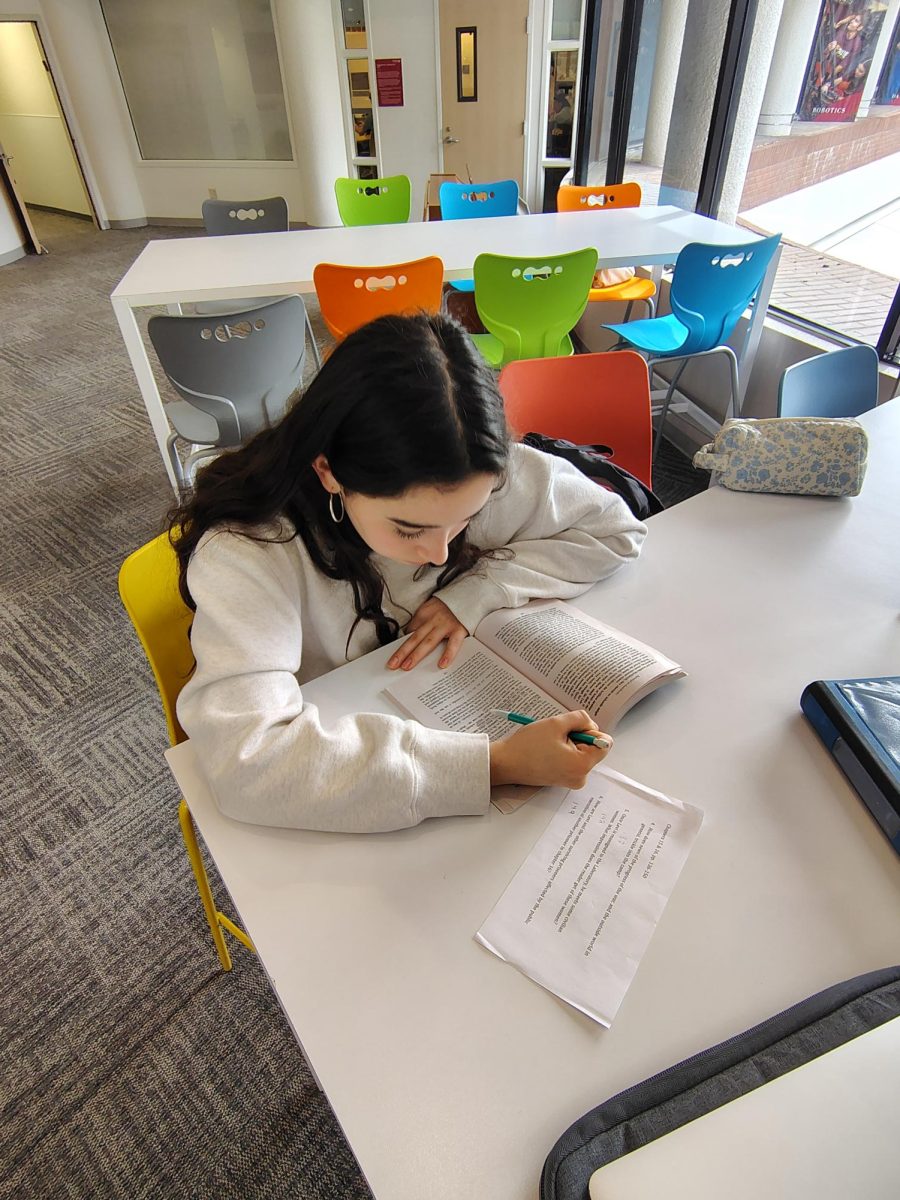

Another dTHS students, Jordan Peterkofsky, who is not a Personal Finance & Economics student, said that she “would love to learn all of this.” She thinks, “it is so important to know how the finance world works but no one ever taught me.”

This is why I believe Personal Finance & Economics should be a graduation requirement.