China Bans Crypto Currency

Volatile Bitcoin Gains Popularity in US

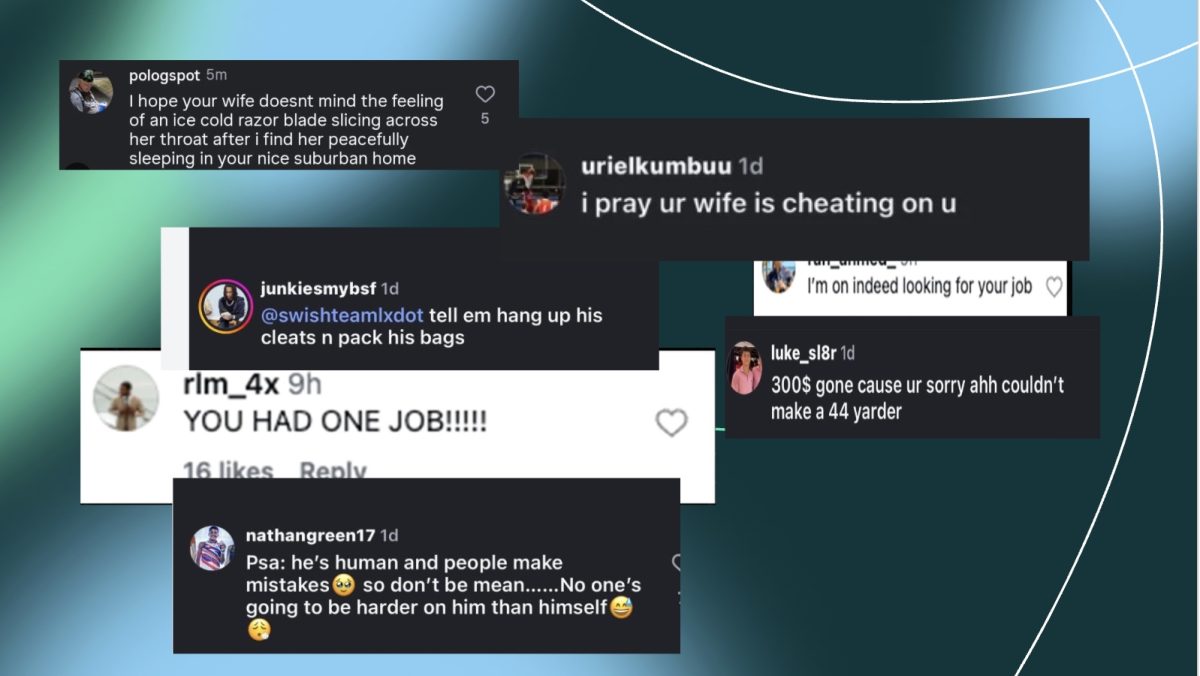

A Bitcoin machine joins the rack of sunglasses and rows of sundries at a local gas station mini-mart.

Last week, China banned all crypto transactions, and even banned banks from handling crypto.

Crypto currency has come a long way from when it was first invented back in 2009. Like PayPal, crypto currencies are an easy, convenient, and secure way to spend and receive money online. The fact that it is completely anonymous incentivises a lot of people to use it as their main form of payment.

Although crypto currency is now banned in China, it is likely to continue to evolve into a monetary system that the rest of the world uses.

Crypto currencies aren’t just used for sending money online. They can also be used as long term investments. This is because as more of a coin is mined, the price will go up. Therefore, if you buy low, over time your investment will gain value. Wallets like Robinhood and Cash App have even implemented crypto trading into their applications.

Soon, according to Reuters, companies like Visa will be allowing customers to pay using crypto, mainly Bitcoin. This will allow someone to purchase items in real life anonymously. As the popularity of crypto currencies continues to grow, new groundbreaking developments will be made that will allow convenience for everyday life.

Bitcoin, the first cryptocurrency, was invented in 2009 by an unknown person who used the pseudonym Satoshi Nakamoto as a way to pay and receive money online. This opened the door for anonymous payments, which is favoured by people who are very privacy-conscious. While many people have loved the idea of Bitcoin and other crypto currencies, China has always been skeptical, citing concerns about gambling fraud and money laundering, reports cnet.com’s Julian Dossett. As a result, in 2013, China banned its banks from handling Bitcoin as an attempt to limit its usage. In 2017, China prohibited its citizens from participating in initial coin offerings, a type of fundraiser where a person invests money to raise money for the startup coin. Then, in 2019, China expressed interest in banning bitcoin mining.

Until now, China has been one of the largest bitcoin miners in the world. According to the University of Cambridge, 47% of crypto mining happened in China in April of 2021, while the United States only accounted for 16.8%.

Bitcoin, unlike any physical currency, is found by mining. Although the name would make you think otherwise, Bitcoins are not actually mined out of the earth. Bitcoin mining is the act of adding a block to a blockchain. A blockchain is a decentralized ledger of all the transactions across a network. Bitcoin is extremely rare, and most people who own bitcoin only have a small fraction of a whole bitcoin.

One of the largest bi-products of the Chinese crypto ban is the shutdown of the second largest Ethereum mine, Sparkpool. Sparkpool is suspending its operations, and denying access to citizens of mainland China. China isn’t the only place Sparkpool will be shutting down, as they released the information that they will be suspending operations in both China and abroad. Sparkpool’s Ethereum mining power makes up 22% of Ethereum’s global hash rate, while the largest Ethereum mine in the world, Ethermine, makes up 24% of Ethereum’s global hash rate. In simple terms, the hash rate is the speed of mining, so Sparkpool is the second fastest Ethereum mine in the world.

The after-effects of the Chinese crypto ban were even felt here, in the United States, as the price of bitcoin fell 3.6% to roughly $42,200.

At the time of this article being written, one bitcoin is worth $41,407.90 U.S. dollars.

Angela Neff • Oct 27, 2021 at 11:18 am

Cole,

This is a complex and interesting article. I would love to learn about the advantages and disadvantages of a digital currency that is international rather than national. Global warming is definitely one BIG disadvantage but I assume there are many others. If you have a deep interest in this topic, I would enjoy reading more!

Peggy Mason • Oct 16, 2021 at 11:18 am

I am amazed! This article is well written, VERY informative, and well organized. Hard to believe that it was written by someone who is 14 years old. Gives me faith in the future of America, that we have young minds like this one! Kuddos Cole

Louise Kahn • Oct 13, 2021 at 6:33 pm

I am Kevin’s mother. My thoughts about crypto:

I believe the hype about crypto currency is a modern tulip fenzy, with money and shall I say dark power behind it.

The fluid value of bitcoin makes its secure use unreliable. I am aware that a country in South America has adopted Bitcoin as its currency and I am waiting for reports.

Mining the coins uses up electricity that, from stories I have read, deplete the utility from communities.

I have been biased from the beginning. Yes, fortunes have and will be made because of the backing of crypto by revered institutions as well as newcomers in the financial world. But just because thousands (or more) of intelligent people believe in it, it doesn’t mean it’s true. .

I had to respond.

Your report is very well written and I appreciate this chance to discuss it with you!

Regards,

Louise K

Savtah • Oct 13, 2021 at 8:39 am

Are you kidding me?!?!!

I am dumbfounded.

Cole wrote that by himself?

I don’t even know what he is talking about. Can he give our family a tutorial?

My friend sells these machines in the picture.

His Mom :) • Oct 12, 2021 at 5:01 pm

Well written and informative article!